It’s that time of year when people are feeling more generous than ever. Many Americans are donating to charitable organizations such as the Red Cross or the Salvation Army. Due to the surge of devastating natural disasters that struck the country this past year, many people have made additional contributions to help the victims rebuild their lives. Most charitable givers do not think twice about the benefits of donating to long-established and well known organizations such as these. However, a closer investigation can tell a different story—a story of mismanaged funds, alleged corruption, and excessive overhead costs.

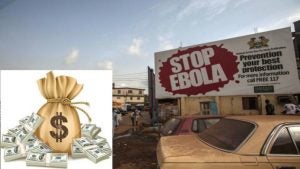

Corruption is a major issue, which has been a hot topic of discussion recently with the International Federation of the Red Cross (IFRC) being linked to corruption accusations related to the Ebola outbreak in West Africa. From 2014 to 2016, the deadly Ebola virus spread throughout West Africa, killing more than 11,000 people and drawing a plethora of aid workers and medical professionals to the region. According to the IFRC, some of the responders fraudulently used funds earmarked for aid. In total, it is estimated that over $6 million was lost, which included $2 million in losses related to collusion between IFRC staff and bank employees in Sierra Leone, $1 million in fraudulent billing in Guinea, and $2.7 million in fraudulent cost inflation, payroll, and volunteer payouts in Liberia.

This isn’t the first time the IFRC has been criticized for botching relief efforts in major times of crisis or for its administrative and fundraising costs. In fact, there is a fairly long history of condemnation of the IFRC and its affiliated organizations. Back in 2005, the American Red Cross (ARC), a branch of the IFRC, stepped in to assist with Hurricane Katrina, which mostly devastated New Orleans, Louisiana. Reports detailed examples of how the organization failed to help hurricane victims. One example involved volunteers arriving with only bleach when people had no food or water, and other donations that were of little use. Another instance described how pastries arrived moldy and inedible because they were shipped without refrigeration. International observers claimed that elements were so bad that they were on the verge of criminal wrongdoing. Relief efforts in Haiti in 2011 following the devastating earthquake were also harshly critiqued. The ARC had raised almost a half a billion dollars yet had very little to show for all of the money that they raised. In 2012, the handling of Superstorm Sandy was also deeply concerning to many, despite an internal retooling effort. In fact, one Red Cross driver called the response “worse than the storm.”

How do you know that the money you are donating to charitable organizations goes to the people who need it the most and that excessive amounts are not being used on administrative costs, including enlarged salaries and huge overhead costs? The publication MONEY advises giving to charities that spend no more than 20% of their revenue on overhead costs. Individuals can search for these numbers on websites such as Charity Navigator.

The site reports that in fiscal year ending June 2015, the ARC spent 10.4% of its revenue on administrative costs and fundraising efforts. However, this is small compared to what some other charitable organizations and nonprofits spend on administrative costs. In 2012, the Diabetes Foundation, with the mission of informing and educating people about Type 2 diabetes, reported a total overhead of 83%. Friends of MS, a charity with a goal to help people with Multiple Sclerosis by supporting research and donating to programs that help those with the disease, reported a total overhead of 83.0% in 2012. Charity Navigator also has a page that lists and evaluates highly-rated national/international organizations.

There are approximately 1.4 million nonprofits in the United States, 1 million of which are public charities. Thus, there are a lot of organizations to choose from. However, before reaching for your wallet and donating to the first charity that comes to mind, this year do your due diligence and take a few minutes to research where and how your charitable donations are actually being spent.